Key Factors

- Oil Market Volatility

OPEC+’s potential output increase in July caps prices amid signs of softening demand.

Sentiment reflects a shift from price defense to reclaiming market share. - BoE Policy Outlook

Sticky food inflation dampens expectations for further BoE rate cuts.

Officials remain cautious, with consensus forming around just one additional cut. - Fed Positioning

Chair Powell reiterated the Fed’s independence, tying any policy move to incoming data.

Summary of Economic Projections may reshape expectations for 2025 cuts. - Tariff Legal Uncertainty

Federal appeals court temporarily reinstated Trump’s tariffs.

Ongoing tariff unpredictability increases investor risk aversion.

Gold Outlook

The legal uncertainty surrounding Trump’s sweeping tariff agenda continues to inject volatility into the global trade and financial landscape. While a federal trade court recently blocked many of the tariffs, considering the methods used to implement them unlawful, a federal appeals court has since granted a temporary stay, allowing the tariffs to remain in effect for now. This pause enables further legal review and delays any meaningful change to the current tariff regime, though the final outcome remains unsettled.

This legal back-and-forth leaves U.S. trade policy in a state of confusion. Tariffs covering steel, aluminum, and specific Chinese imports remain in place, but others, like flat-rate “reciprocal” tariffs, are at risk pending judicial review. Meanwhile, the Trump administration shows no signs of backing down, hinting at alternative strategies and a willingness to escalate the issue to the Supreme Court if necessary. In parallel, trade negotiators are pursuing separate discussions with key partners such as India and the EU, signaling that behind-the-scenes diplomacy is still active despite the legal headwinds.

For the market, this environment of prolonged uncertainty carries implications beyond trade alone. Unpredictability affects corporate pricing decisions, global supply chains, and investor sentiment. In particular, policy instability tends to drive demand for safe haven assets, with gold likely to remain the primary beneficiary. As confidence in trade clarity wanes and risks of retaliatory trade actions increase, investors are more likely to hedge against volatility and risk by increasing their allocations in safer bets. This dynamic could offer upward pressure on the precious metal, especially if geopolitical tensions from Ukraine to the Middle East add to the mix in the weeks.

Technical Forecast

Gold is still consolidating after failing to break above the $3440 supply area, a rejection that triggered losses toward the $3250 area and reflects a short-term bearish undertone. However, the big picture remains optimistic. The flag-shaped pause merely reveals a slowdown in momentum after a surge in April. The recent swing low of $3140 is the immediate support level where a breach could open the door for further declines toward the round number $3000, a critical level for the bulls to stay in the game. On the upside, a break above $3430 would shift the tone back to bullish, exposing the previous all-time high of at $3500. This would signal a bullish continuation and send the bullion price toward $3600.

GBP Outlook

The Bank of England’s monetary easing trajectory has been complicated by persistent food inflation and higher-than-expected consumer price data, casting doubt over further near-term rate cuts. May marked the fourth consecutive monthly rise in food inflation, driven by fresh produce and meat, with the CPI climbing to 3.5% in April, well above the 2% target. This has reinforced concerns that the UK economy is grappling with structurally higher post-pandemic inflation, exacerbated by a sharp minimum wage hike.

Despite the central bank lowering its base rate to 4.25% earlier this month, internal dissent remains. Key policymakers, including Chief Economist Huw Pill, have signaled concern over cutting rates prematurely. Market consensus have adjusted their rate outlooks, now projecting fewer cuts this year and a slower path to normalization, potentially extending into 2026.

Adding complexity is the divergence within inflation categories: non-food goods remain deflationary, but essential categories like groceries continue to rise, impacting consumer sentiment and real wages. Meanwhile, broader retail price stability suggests inflation may be unevenly distributed across sectors.

The IMF’s endorsement of gradual easing aligns with the BoE’s cautious stance, acknowledging the challenge of balancing fragile growth with inflation control. For markets, this dynamic implies sustained uncertainty around the UK rate path, with a potential for delayed or fewer cuts, especially if inflation proves more entrenched. Sterling may find limited support in the short-term though its long-term trajectory could be hindered by said fundamental uncertainties. Upcoming CPI prints and wage data will be critical to shaping the BoE’s decisions into the second half of the year.

Technical Forecast

GBP/USD remains firmly within a rising channel, underscoring a prevailing bullish trend. The price is eyeing the 1.3800 level as immediate resistance, with a broader target set around the psychological 1.4000 zone, aligning with the upper trajectory of the channel. Support is seen at 1.3240, followed by the 30-day SMA and the lower boundary of the channel near 1.3150. These levels provide potential zones for bullish re-engagement on any dips. However, caution is warranted as the RSI approaches the overbought mark, signaling overextension. This raises the possibility of a short-term correction. A failure to hold above 1.3440 may display weakening bullish momentum, with the risk of a deeper pullback toward the 1.3090 area. In summary, while the broader outlook remains bullish, near-term price action may be vulnerable to consolidation or a correction before any sustained move higher.

S&P 500 Outlook

The recent meeting between Federal Reserve Chair Jerome Powell and Donald Trump underscores the ongoing tension between political influence and central bank independence. While Trump urged Powell to cut interest rates, arguing that the current stance disadvantages the U.S. economy relative to global competitors like China, Powell emphasized the Fed’s commitment to data-driven, non-political decision-making. According to the Fed, Powell refrained from discussing policy expectations, instead stressing that monetary policy will be shaped entirely by economic developments and objective analysis.

This interaction comes at a time when global economic conditions remain fragile and uncertain, with trade tensions, diverging inflation trends, and varying growth trajectories influencing monetary policy across major economies. Despite pressure from the White House and speculation over Powell’s future at the Fed, the central bank strives to stay independent in its policy-making.

Looking ahead, the FOMC is expected to hold rates steady at its upcoming decision on June 18. However, the meeting may be significant in shaping expectations for monetary policy for the remainder of 2025. Policymakers will update the Summary of Economic Projections, which includes forecasts for interest rates, inflation, and growth. These updates will be influenced by key data releases in the weeks ahead, particularly on jobs and inflation.

Sentiment around the U.S. economy has improved somewhat since the initial shock of new tariffs. Recession risk for 2025, as measured by prediction markets like Polymarket, has declined from over 60% in early May to under 40%. Equity markets have rebounded, with the S&P 500 now slightly up for the year after a volatile April. While markets still anticipate two rate cuts by the end of 2025, the range of outcomes remains broad. June’s FOMC meeting is not expected to bring a rate move, but it may prove crucial in signaling where policymakers believe interest rates are heading in the second half of the year.

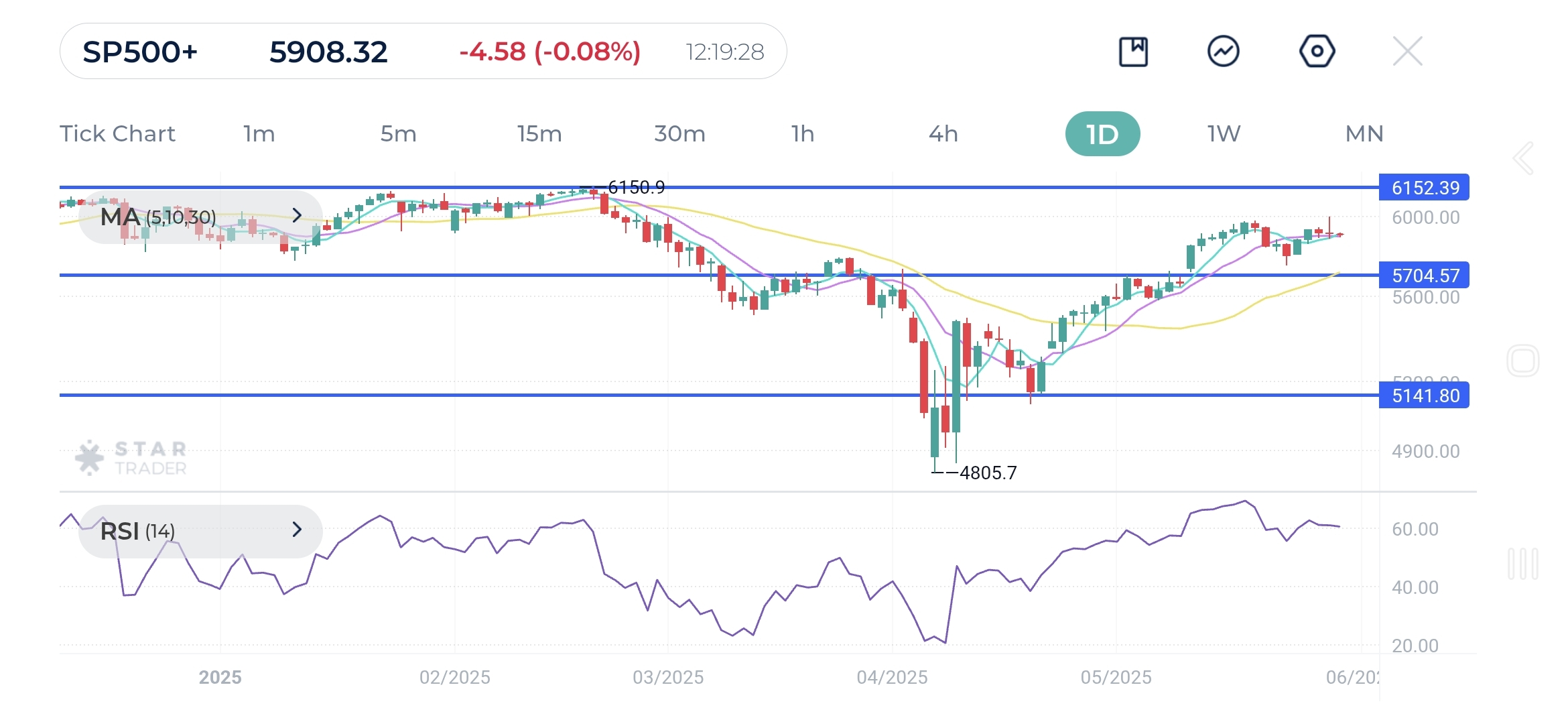

Technical Forecast

After a swift rebounce from the 4840 swing low, there may be breakout opportunities around the psychological level of 6000, with prior resistance at 6150 serving as the next logical topside target in the event of trend continuation. Potential pullbacks cannot be excluded to let bulls catch their breath. 5700 alongside the rising 30-day SMA remains relevant as an initial zone of interest, which coincides with an unfilled gap from early May, covering the range between 5660 and 5730, and could see possible demand emerging. Further down, 5140 around the initial breakout surge is a key support zone. Holding above it is essential for bulls to maintain control, and failure to do so may open the door to deeper downside risk and broader breakdown potential.

Oil Outlook

Oil prices continue to face downside pressure as supply-side expectations shifted meaningfully. Investor sentiment turned cautious following reports that OPEC+ may raise output by 411,000 barrels per day starting in July, with further unwinding of production cuts potentially bringing 2.2 million bpd back online by November. This signals a pivot from defending prices to regaining market share, notably by Saudi Arabia and other key producers. The shift risks overwhelming demand recovery, especially amid a backdrop of uncertain global economic growth.

Concurrently, the U.S. Energy Information Administration (EIA) reported a surprise build in crude and refined product inventories, challenging expectations for a drawdown. Rising imports and weaker gasoline and distillate demand point to softening domestic consumption, which may intensify downward pressure on WTI crude and raise incentives for U.S. exporters to divert barrels to Asia and Europe.

While some geopolitical support remains, such as the potential expiration of Chevron’s license to operate in Venezuela, which could disrupt sanctioned supply, markets appear skeptical due to the likelihood of U.S. policy extensions.

In summary, the short-term crude oil outlook remains fragile, shaped by a mix of supply-side uncertainty, muted demand signals, and shifting OPEC+ policy dynamics. With the June 1 OPEC+ meeting approaching, traders will be closely watching for clarity on whether producers will prioritize price stability or market share, a choice that could define the trajectory of prices through the second half of 2025.

Technical Forecast

The price action has shown some resilience after testing $55 in April and again in early May. If the current pause falls short of confirming a double bottom, support could be fragile. For bulls, the key test lies at the $67 level, which acted as support before the March sell-off. Further up, the swing high of $72 is a major ceiling where a decisive break would signal a bullish reversal is underway. Until then, rallies should be viewed as counter-trend moves. On the downside, support around $55 remains a crucial line of defense, as its breach would bring $51 and potentially $48 back into focus. In short, WTI’s outlook remains cautious at best with a bearish bias as few technical signs are in the bulls’ favor in the medium-term. Only a sustained move with strong momentum above said resistance would shift the narrative.

Key Dates

- Tuesday, Jun 03

- Eurozone Inflation Rate

- Wednesday, Jun 04

- BoC Interest Rate Decision

- Thursday, Jun 05

- ECB Interest Rate Decision

- Friday, Jun 06

- Non Farm Payrolls

- Wednesday, Jun 11

- US CPI

- Wednesday, Jun 18

- Fed Interest Rate Decision

- Thursday, Jun 19

- BoE Interest Rate Decision

- Tuesday, Jun 24

- BoC CPI

Tags

Open Live Account

Please enter a valid country

No results found

No results found

Please enter a valid email

Please enter a valid verification code

1. 8-16 characters + numbers (0-9) 2. blend of letters (A-Z, a-z) 3. special characters (e.g, !a#S%^&)

Please enter the correct format

Please tick the checkbox to proceed

Please tick the checkbox to proceed

Important Notice

STARTRADER does not accept any applications from Australian residents.

To comply with regulatory requirements, clicking the button will redirect you to the STARTRADER website operated by STARTRADER PRIME GLOBAL PTY LTD (ABN 65 156 005 668), an authorized Australian Financial Services Licence holder (AFSL no. 421210) regulated by the Australian Securities and Investments Commission.

CONTINUEImportant Notice for Residents of the United Arab Emirates

In alignment with local regulatory requirements, individuals residing in the United Arab Emirates are requested to proceed via our dedicated regional platform at startrader.ae, which is operated by STARTRADER Global Financial Consultation & Financial Analysis L.L.C.. This entity is licensed by the UAE Securities and Commodities Authority (SCA) under License No. 20200000241, and is authorised to introduce financial services and promote financial products in the UAE.

Please click the "Continue" button below to be redirected.

CONTINUEError! Please try again.